As of my last knowledge update in January 2022, I don’t have real-time data, and I can’t verify the current price of Bitcoin. Cryptocurrency prices are highly volatile and can change rapidly. If Bitcoin is indeed priced at US$44 thousand, it’s important to note that these values can fluctuate based on market demand, investor sentiment, regulatory developments, and various other factors.

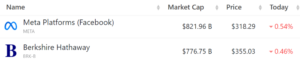

Comparing the valuation of Bitcoin to companies like Meta (formerly Facebook) and Berkshire Hathaway is interesting but keep in mind that Bitcoin’s valuation is driven by market dynamics, while company valuations are based on various financial metrics.

For the latest and most accurate information on Bitcoin’s price and comparisons to other assets, please check reliable financial news sources or cryptocurrency market platforms.

BTC again touched its highest price in 2023 at US$44,530 (6/12/23) at 05.00 WIB. This price increase caused Bitcoin’s valuation to beat the valuation of Mark Zuckerberg’s company, Meta and Warren Buffet’s company, Berkshire Hathaway.

BTC Valuation Overtakes Meta and Berkshire Hathaway

The price of Bitcoin touched US$44,530, the highest price this year, and as of this article being written (6/12/23) Bitcoin was trading at US$43,892. In just a week, Bitcoin recorded an increase of +17%, which is a significant increase for an asset with a large market capitalization. Overall, Bitcoin has gained +165% year to date (YTD).

Image: BTC price chart

As the price of Bitcoin increased, valuations also increased with Bitcoin’s valuation touching US$857.3 billion. This valuation has surpassed well-known large companies such as Meta (formerly Facebook) with a valuation of US$821.9 billion and Berkshire Hathaway with a valuation of US$776.7 billion.

Image: Bitcoin price and valuation. Source: Coinmarketcap

Image: Meta and Berkshire Hathaway Valuation. Source: Marketcap Companies

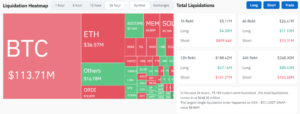

Total IDR 3.8 Trillion Liquidated Futures Positions

A significant increase in Bitcoin prices is not pleasant for everyone, especially traders who place SHORT positions on Bitcoin trading pairs. Based on Coinglass data, there was US$248 million or around Rp. 3.8 trillion in futures positions that were liquidated in the last 24 hours.

Image: Liquidation map of futures positions. Source: Coinglass

There were 65.48% of SHORT positions and 34.52% of LONG positions liquidated in the last 24 hours, indicating that traders did not expect Bitcoin to experience another increase after touching a price level above US$40,000.

Bitcoin trading was the largest contributor to liquidations, namely US$113.71 million. Ethereum took second place with total liquidations of US$36.57 million. ORDI’s BRC-20 token was ranked third in liquidation contributors with US$10 million.

Leave a Reply